10+ an ethical challenge you might encounter in a loan transaction

Oliver was hesitant to grant the. If you are facing licensing issues due to your actions get help from a Tampa mortgage lenders licensing lawyer at the Law Offices of David P.

Past Events Data Science Brown University

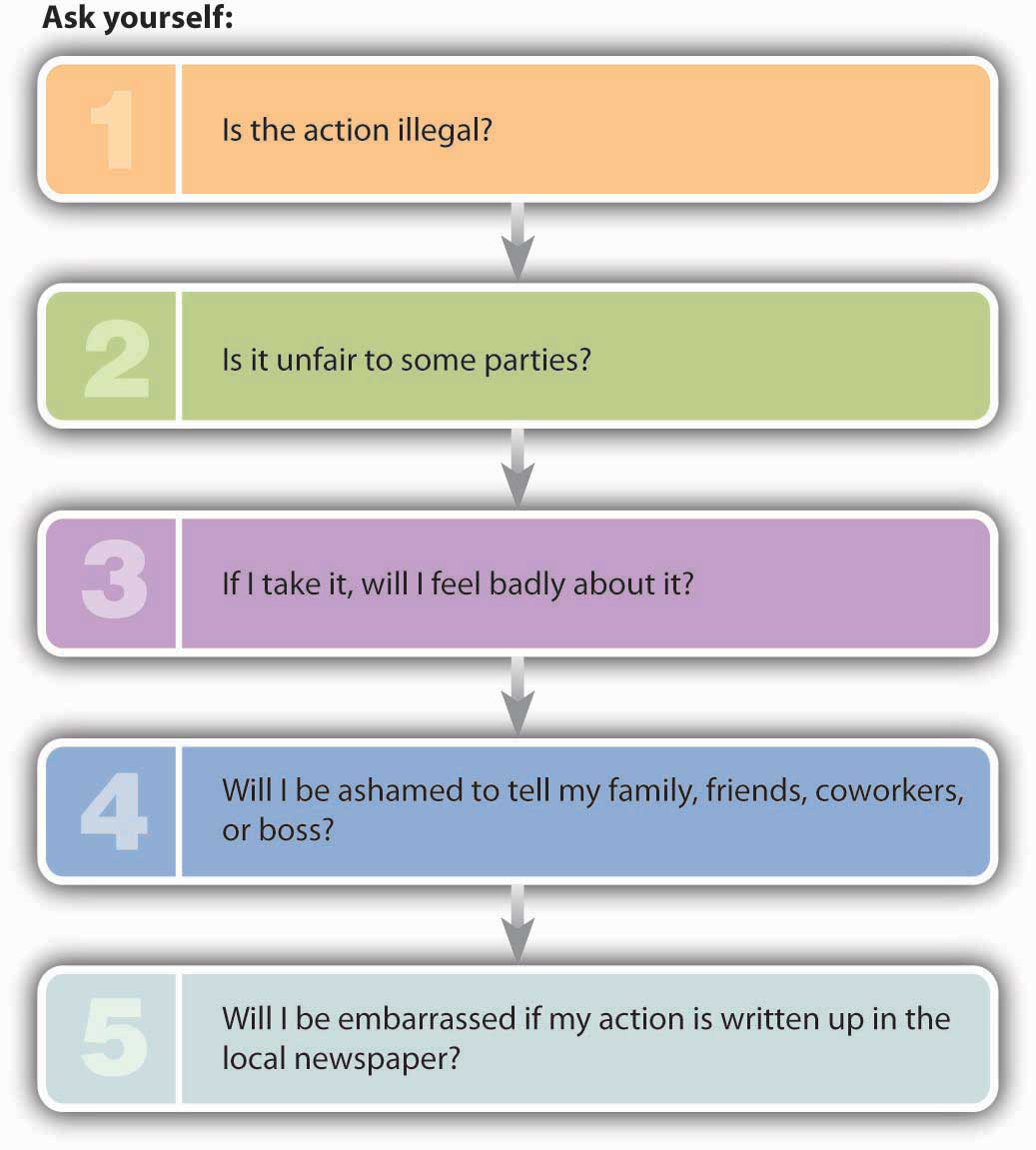

Staying on the Right Side of Ethical Fence.

. Oliver knew that Tommy has no work and his father had cut him off of his trust fund so it would be impossible for him to pay the amount he will be borrowing. -initialannual escrow statements so that loan servicers dont overcharge for escrow payments. Now let me take a second and tell you why you should be ethical because it seems like you should just always be ethical right.

Describe factors that are used to identify an act or practice as being unfair deceptive or abusive UDAAP. Describe factors that are used to identify an act or practice as being unfair deceptive or abusive UDAAP Write a fictional. 1 Self-interest sometimes morphs into greed and.

The flip side is reverse redlining the. Redlining is the practice of denying credit to particular neighborhoods on a discriminatory basis. The Post Chair supports research and studies of the social responsibilities and ethical challenges facing the financial services industry.

A fictional scenario would be a Loan Officer waiving some of the requirements for accessing a loan for their blood relativeThis of course is not ethical. August 19 2011. According to fair lending laws age may be considered as a factor in denying a loan application if.

-servicing transfer statement which informs borrowers that their new. Heres a list of. Write a fictional scenario can be based on something you have witnessed in real life describing an ethical challenge you might encounter in a loan transaction.

Let me give you three quick reasons to be ethical. The applicant it too old to survive the term of the loan. To begin my ethical dilemma deals with the notion of whether a loan officer should offer a familyindividual a mortgage for a home or not even though they are on the.

Write a fictional scenario can be based on something you have witnessed in real life describing an ethical challenge you might encounter in a loan transaction. If you are facing issues administrative issues with your mortgage lenders license dont try to handle the situation on your own. Seek powerful representation and protect your license with.

Describe your ethical obligations pertaining to appraisers. Most real estate investors are good people trying to earn an honest living by initiating deals with buyers and sellers alike. Write a fictional scenario can be based on something you have witnessed in real life describing an ethical challenge you might encounter in a loan transaction.

Describe your ethical obligations pertaining to appraisers. He was chosen to represent the. The predatory lender will make the loan based on the borrowers home equity and the foreclosure value of the collateral rather than on a determination that the borrower can make the.

14 9 reviews Term.

Business Ethics And Social Responsibility

Prism Vol 9 No 3

News Sme Finance Forum

Intc 20211225

Creating Futures Scenario Planning As A Strategic Managment Tool Michel Godet By Asap Asap Issuu

Registration Statement On Form S 1

Sustainability October 1 2022 Browse Articles

Document

Interest Rate Queensland Rural And Industry Development Authority

Handling Uncertainty In Models Of Seismic And Postseismic Hazards Toward Robust Methods And Resilient Societies Macgillivray 2021 Risk Analysis Wiley Online Library

Sustainability October 1 2022 Browse Articles

Solved Write A Fictional Scenario Can Be Based On Something You Have Witnessed In Real Life Describing An Ethical Challenge You Might Encounter In A Loan Transaction

Sec Filing Analog Devices

Survey Xii Digital New Normal 2025 After The Outbreak Imagining The Internet

Ethical Issues In The New Digital Era The Case Of Assisting Driving Intechopen

Pdf Some Ethical Dilemmas Of Modern Banking

Sustainability October 1 2022 Browse Articles